Washington State

Where Community and Opportunity Thrive

Washington State continues to offer a strong and diversified rental housing market. Anchored by the dynamic economy of Seattle and supported by stable growth in cities like Spokane, Bellingham, Wenatchee, Olympia, and the Tri-Cities, this region remains a strategic focus for Summerfield Property Management.

We manage multifamily communities across the state, bringing our operational expertise to properties ranging from vibrant urban hubs to high-demand suburban and tertiary markets.

What we love about Washington

Washington State boasts a resilient and future-focused economy, creating strong fundamentals for the multifamily rental market. Major private employers anchor the state’s economic strength across sectors like technology, aerospace, healthcare, and logistics. Amazon and Microsoft—both headquartered in the Seattle metro—employ over 100,000 and 50,000 people respectively in the region, making Washington a global hub for tech innovation. Boeing remains one of the state’s largest employers, with thousands of jobs in aerospace engineering and advanced manufacturing centered around Everett and Renton.

In the healthcare sector, Providence Health & Services, MultiCare Health System, and UW Medicine support tens of thousands of jobs statewide, particularly in the Puget Sound and Spokane regions. Meanwhile, companies like Costco, T-Mobile, and Starbucks, all headquartered in Washington, contribute to a stable and diversified employment base.

Unlike states with a single economic engine, Washington features a network of thriving cities—such as Spokane, Olympia, the Tri-Cities, Bellingham, and Wenatchee—each contributing to a stable, balanced, and geographically diverse rental landscape. The state’s blend of economic opportunity, quality of life, and long-term job growth continues to attract residents and investors alike.

At a Glance

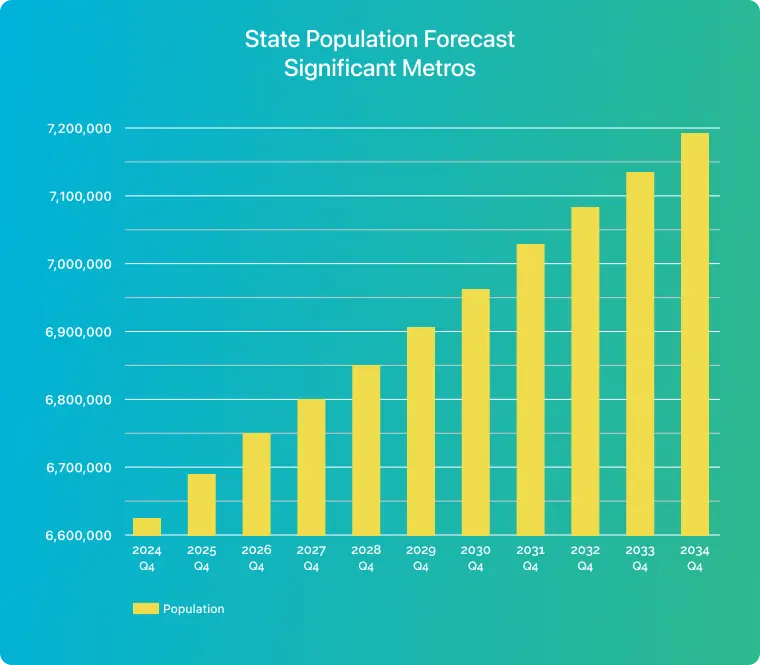

Population Growth

A steady influx of new residents drawn by career opportunities and natural beauty

Average Income

Higher-than-average household income supports strong rental fundamentals

Number of Properties

Expanding portfolio in urban and emerging submarkets

Management Approach

Hands-on, data-driven strategies tailored to each asset’s local market dynamics

Market Insights

Washington’s economic diversity and continued population growth create long-term stability for multifamily investments. Markets like Spokane and the Tri-Cities are attracting both renters and investors, with strong fundamentals and development-friendly environments.

2024 Q4

6,621,992

2025 Q4

6,691,190

2026 Q4

6,748,411

2027 Q4

6,800,232

2028 Q4

6,852,020

2029 Q4

6,906,707

2030 Q4

6,963,458

2031 Q4

7,022,603

2032 Q4

7,081,023

2033 Q4

7,138,436

2034 Q4

7,194,836

Challenges

Regulatory Complexity

Navigating evolving local housing policies and tenant protection laws

Infrastructure Strain

Managing growth while addressing transportation and development limitations

Affordability Pressures

Balancing quality housing delivery with regional affordability goals

Looking Ahead

Washington’s job market is projected to grow by over 10% between 2023 and 2033, with particularly strong gains expected in healthcare, education, professional services, and logistics. This ongoing expansion fuels housing demand across both major metros and emerging regional cities.

Whether it’s repositioning value-add assets in Puget Sound or optimizing operations in high-occupancy Eastern Washington communities, our team brings tailored, on-the-ground solutions backed by national experience.

Local Presence,

Regional Expertise

Our Washington operations are supported by our Northwest Regional Headquarters in Seattle.

Ready to Learn More?

Let’s talk about how we manage better in Washington State.