South Carolina

Where Growth, Charm, and Value Meet

South Carolina offers a compelling combination of economic expansion, cultural appeal, and rising demand for quality rental housing. From the economic vitality of Charleston and Columbia to the up-and-coming cities of Greenville, Spartanburg, and Myrtle Beach, South Carolina is a high-opportunity region for Summerfield Property Management.

We operate multifamily communities across both urban and suburban areas of the state, delivering performance-driven management tailored to each market’s needs.

What we love about South Carolina

South Carolina’s economic growth is supported by a diverse set of industries, including manufacturing, aerospace, automotive, healthcare, and logistics. Anchored by major employers like Boeing, BMW, Prisma Health, and the Medical University of South Carolina, the state continues to attract both employers and new residents.

BMW’s Spartanburg plant, the company’s largest in the world, employs over 11,000 and has helped establish the Upstate as a manufacturing powerhouse. Boeing, with over 8000 employees in North Charleston, anchors the state’s aerospace sector. Prisma Health is South Carolina’s largest healthcare system, employing more than 30,000 people, while MUSC continues to expand its research and clinical footprint.

South Carolina also benefits from its strategic coastal location, with the Port of Charleston ranking among the busiest in the U.S., supporting strong job creation in logistics and trade.

Driven by low taxes, business incentives, and an affordable cost of living, South Carolina is attracting residents from across the country, particularly from the Northeast and Midwest.

At a Glance

Population Growth

Strong net migration and regional expansion fueled by affordability and job creation

Average Income

Modest but rising wages, especially in healthcare, manufacturing, and logistics

Number of Properties

Growing portfolio in Charleston, Columbia, and Greenville-Spartanburg corridor

Management Approach

Market-responsive operations that emphasize tenant satisfaction and value creation

Market Insights

South Carolina’s rental market is marked by strong demand and steady occupancy across metro and secondary markets. Areas like Charleston and Greenville have seen significant multifamily development, while Columbia and Myrtle Beach continue to attract renters due to their affordability and quality of life.

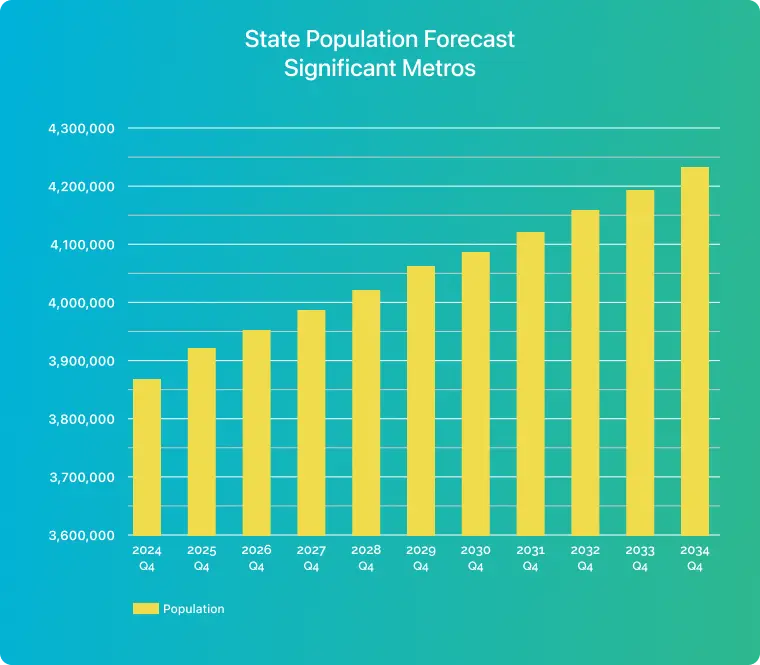

2024 Q4

3,874,093

2025 Q4

3,918,311

2026 Q4

3,952,008

2027 Q4

3,985,186

2028 Q4

4,018,207

2029 Q4

4,051,977

2030 Q4

4,086,288

2031 Q4

4,121,278

2032 Q4

4,156,155

2033 Q4

4,190,902

2034 Q4

4,225,503

Challenges

Regulatory Change

Monitoring evolving local regulations around zoning and landlord-tenant laws

Development Pressures

Balancing growth with infrastructure demands, particularly in fast-expanding metros

Competitive Leasing Markets

Maintaining occupancy and NOI in markets experiencing new multifamily supply

Looking Ahead

South Carolina’s employment base is expected to grow by more than 9% between 2023 and 2033, with standout gains in logistics, healthcare, and professional services. As in-migration continues and the state remains a destination for retirees, remote workers, and families alike, demand for well-managed rental housing will persist across asset classes.

Whether repositioning communities in Columbia or enhancing NOI on stabilized properties in Charleston, our teams deliver results rooted in local expertise and national best practices.

Local Presence,

Regional Expertise

Our South Carolina operations are supported by our Southeast Regional Headquarters in Atlanta, with dedicated teams managing on-the-ground performance statewide.

Ready to Learn More?

Let’s talk about how we manage better in South Carolina.