Oregon

Where Community and Opportunity Thrive

Oregon offers a unique blend of livability, economic resilience, and rental housing demand. From the cultural vibrancy of Portland to the growing opportunities in Eugene, Salem, and Bend, Oregon’s multifamily market remains a key region for Summerfield Property Management.

We manage a diverse mix of properties across Oregon’s urban cores and emerging cities, providing value-driven operational excellence in every community we serve.

What we love about Oregon

Oregon’s economy is both diverse and dynamic, offering a robust foundation for the rental housing market. Major private employers—including Providence Health & Services, Intel, Nike, and Oregon Health & Science University—anchor the state’s economic strength in healthcare, technology, and manufacturing.

Providence Health & Services employs over 23,000 individuals in the Portland area, while Intel’s Hillsboro campus employs more than 22,000. Nike, headquartered in Beaverton, supports approximately 11,400 jobs, and OHSU employs over 19,000 people statewide.

Looking ahead, Oregon’s job market is projected to grow by 8% between 2023 and 2033, adding roughly 170,000 new jobs across diverse sectors. This steady employment growth—paired with high quality of life and a reputation for innovation—continues to attract both residents and investors to the state.

At a Glance

Population Growth

Consistent in-migration driven by lifestyle appeal and job opportunities

Average Income

Competitive wages paired with an entrepreneurial spirit

Number of Properties

Growing footprint across both metro Portland and regional cities

Management Approach

Customized strategies for asset performance, local compliance, and resident satisfaction

Market Insights

Oregon’s rental market reflects a mix of stability and opportunity. While Portland continues to evolve under shifting housing regulations, secondary markets like Salem and Eugene are seeing increased investor and resident interest. These cities offer lower barriers to entry and high rental occupancy, making them attractive for both acquisition and operations.

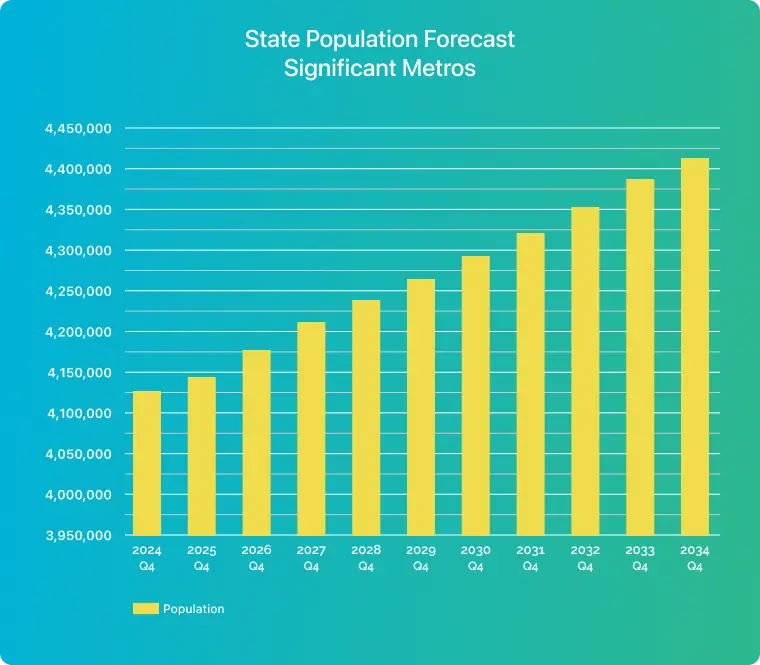

2024 Q4

4,120,514

2025 Q4

4,145,599

2026 Q4

4,176,149

2027 Q4

4,204,957

2028 Q4

4,233,706

2029 Q4

4,263,039

2030 Q4

4,292,580

2031 Q4

4,322,324

2032 Q4

4,351,766

2033 Q4

4,380,853

2034 Q4

4,409,501

Challenges

Regulatory Landscape

Adapting to statewide rent control and evolving landlord-tenant legislation

Urban Redevelopment

Navigating gentrification and equitable growth in key submarkets

Affordability Trends

Managing rising construction and operating costs while keeping units attainable

Looking Ahead

Oregon’s long-term housing demand is supported by an expanding job market and a livability profile that continues to attract new residents. As employment opportunities grow across healthcare, technology, and education, so does the need for quality rental housing in both metro and regional areas.

Whether optimizing stabilized assets in Portland or expanding into high-occupancy regional cities like Bend and Eugene, our local teams deliver customized solutions rooted in deep market knowledge.

Local Presence,

Regional Expertise

Our Oregon operations are coordinated through our Northwest Regional Headquarters in Seattle, supporting on-the-ground teams throughout the state.

Ready to Learn More?

Let’s talk about how we manage better in Oregon.