Idaho

Rooted in Livability, Driven by Opportunity

Idaho continues to stand out for its strong population growth, business-friendly climate, and increasing demand for quality rental housing. From the dynamic capital of Boise to rapidly growing cities like Meridian, Nampa, and Idaho Falls, Idaho’s multifamily market is a compelling region for Summerfield Property Management.

We manage a broad mix of properties across Idaho’s metro areas and regional growth centers, delivering operational excellence and value in every community we serve.

What we love about Idaho

Idaho’s economy is fueled by a mix of technology, healthcare, education, and agriculture—creating a stable foundation for housing investment. Key employers such as St. Luke’s Health System, Micron Technology, Idaho National Laboratory, and Albertsons contribute significantly to the state’s economic momentum.

St. Luke’s is Idaho’s largest private employer, with more than 15,000 employees statewide. Micron Technology, headquartered in Boise, employs over 6,000 people in the region. Albertsons, also based in Boise, supports approximately 5,000 jobs locally, while Idaho National Laboratory adds another 4,000+ high-paying jobs in eastern Idaho.

Idaho’s job market is projected to grow by over 10% from 2023 to 2033—outpacing the national average. This strong employment growth, combined with a reputation for livability and outdoor lifestyle, continues to attract new residents and investment interest across the state.

At a Glance

Population Growth

High in-migration driven by affordability, quality of life, and job creation

Average Income

Rising median wages in key growth sectors

Number of Properties

Expanding portfolio across Boise metro and regional cities

Management Approach

Tailored asset strategies with an emphasis on compliance and resident experience

Market Insights

Idaho’s rental housing market is marked by strong demand and constrained supply, especially in the Boise metropolitan area. As housing costs continue to rise in western states, Idaho offers a more attainable option for both renters and investors. Secondary markets such as Twin Falls and Coeur d’Alene are seeing elevated occupancy and investor activity, benefiting from growth spillover and local economic expansion.

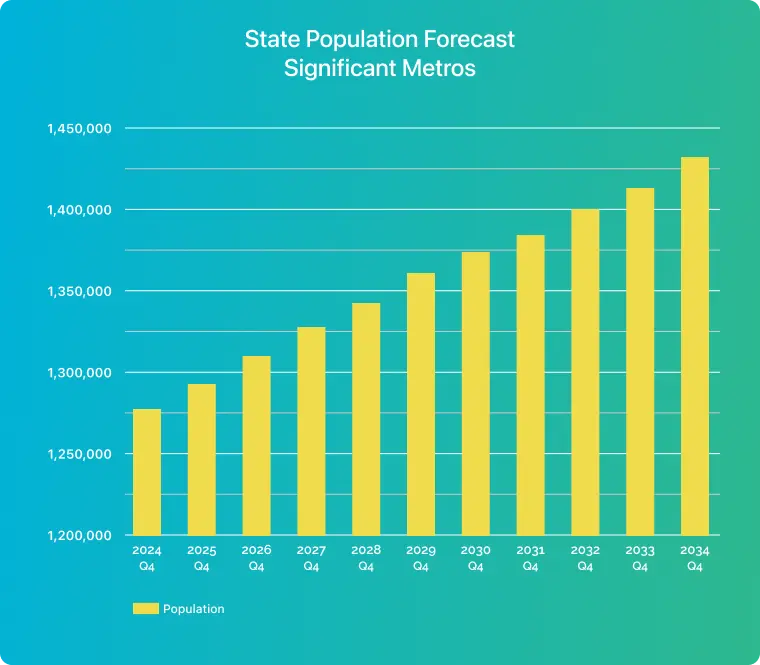

2024 Q4

1,275,999

2025 Q4

1,293,853

2026 Q4

1,310,603

2027 Q4

1,325,831

2028 Q4

1,340,853

2029 Q4

1,355,917

2030 Q4

1,370,659

2031 Q4

1,385,291

2032 Q4

1,399,551

2033 Q4

1,413,404

2034 Q4

1,426,828

Challenges

Regulatory Landscape

Navigating local development requirements and evolving zoning policies

Urban Redevelopment

Balancing rapid growth with infrastructure capacity and community needs

Affordability Trends

Managing rent growth amid rising construction and insurance costs

Looking Ahead

Idaho’s long-term outlook remains positive, driven by steady job creation, continued in-migration, and a pro-growth business environment. As more professionals, families, and retirees relocate to the state, the need for quality rental housing is expected to grow across both primary and secondary markets.

Whether managing stabilized assets in Boise or expanding into high-demand cities like Meridian and Idaho Falls, our teams deliver customized strategies informed by strong local market knowledge.

Local Presence,

Regional Expertise

Our Idaho operations are supported through our Northwest Regional Headquarters in Seattle, with dedicated teams managing onsite operations across the state.

Ready to Learn More?

Let’s talk about how we manage better in Idaho.