Georgia

A Southeastern Powerhouse for Growth and Investment

Washington State continues to offer a strong and diversified rental housing market. Anchored by the dynamic economy of Seattle and supported by stable growth in cities like Spokane, Bellingham, Wenatchee, Olympia, and the Tri-Cities, this region remains a strategic focus for Summerfield Property Management.

We manage multifamily communities across the state, bringing our operational expertise to properties ranging from vibrant urban hubs to high-demand suburban and tertiary markets.

What We Love About Georgia

Georgia boasts one of the most diverse and rapidly expanding economies in the Southeast. Anchored by Atlanta—home to Fortune 500 companies like Delta Air Lines, The Home Depot, Coca-Cola, and UPS—the state is a magnet for corporate relocations and job seekers alike. Atlanta’s role as a logistics and transportation hub, bolstered by Hartsfield-Jackson International Airport, further strengthens its national and global connectivity.

Healthcare and higher education also play vital roles in Georgia’s economy. Emory University and Emory Healthcare together employ over 30,000 people in the state. Piedmont Healthcare, Wellstar Health System, and Augusta University Health are other major employers supporting strong demand in medical and academic sectors.

The Port of Savannah, one of the fastest-growing container ports in the U.S., fuels economic activity in coastal regions and supports robust job creation in logistics, manufacturing, and trade.

Georgia’s combination of affordability, quality of life, and economic mobility makes it a top destination for individuals and families relocating from higher-cost regions.

At a Glance

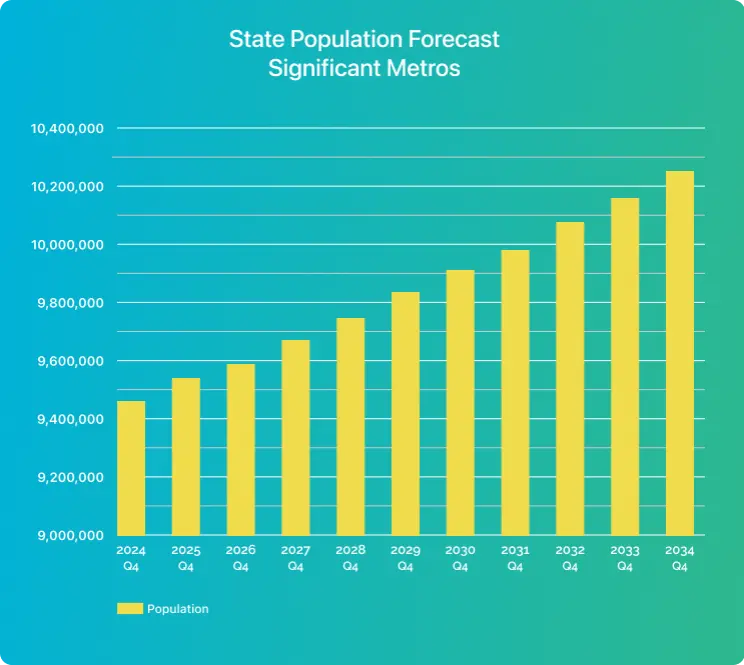

Population Growth

High in-migration and natural growth driven by affordability and opportunity

Average Income

Stable and rising incomes, particularly in Metro Atlanta and coastal growth corridors

Number of Properties

Established presence in Atlanta metro and growing portfolio in regional cities

Management Approach

Scalable strategies focused on NOI improvement and long-term asset value

Market Insights

Georgia’s rental market remains strong, especially in metro Atlanta where high demand meets limited housing supply. Submarkets like Gwinnett, Cobb, and DeKalb counties offer solid investment fundamentals, while secondary markets such as Savannah are gaining investor interest due to economic diversification and job growth.

With rising construction costs and ongoing supply constraints, professionally managed communities that prioritize tenant retention and operational efficiency have a competitive edge.

2024 Q4

9,446,879

2025 Q4

9,514,106

2026 Q4

9,587,083

2027 Q4

9,661,085

2028 Q4

9,735,350

2029 Q4

9,813,356

2030 Q4

9,894,654

2031 Q4

9,979,441

2032 Q4

10,064,339

2033 Q4

10,149,069

2034 Q4

10,233,502

Challenges

Urban Infrastructure Strain

Managing growth in Atlanta and other fast-expanding areas while ensuring livability and access

Zoning and Regulation

Navigating varying municipal policies, especially in larger cities with evolving housing regulations

Affordability Tensions

Balancing rising rents with tenant expectations and affordability goals

Looking Ahead

Georgia’s job market is projected to grow by over 10% between 2023 and 2033, with major expansions expected in healthcare, logistics, information technology, and construction. With a pro-business climate and strong in-migration, the demand for high-quality, professionally managed rental housing will continue to rise across the state.

From optimizing performance in Class B assets across the Atlanta suburbs to stabilizing communities in high-demand cities like Savannah, our local teams execute on strategies that drive results.

Local Presence,

Regional Expertise

Our Georgia operations are led through our Southeast Regional Headquarters in Atlanta, with on-the-ground teams managing assets throughout the state.

Ready to Learn More?

Let’s talk about how we manage better in Georgia.