Florida

Vibrant Demand Meets Year-Round Opportunity

Florida continues to rank among the top U.S. states for population growth, rental demand, and investor interest. With a dynamic economy, expanding job markets, and diverse housing needs, Florida presents a wide range of opportunities for Summerfield Property Management. From the high-growth metros of Orlando, Tampa, and Miami to rising secondary markets like Jacksonville, Sarasota, and Fort Myers, we deliver tailored management solutions across the state.

We operate multifamily properties throughout Florida, combining local expertise with proactive, performance-driven oversight.

What we love about Florida

Florida’s economy is among the largest and most diverse in the country. Major industries—including tourism, healthcare, logistics, aerospace, finance, and technology—create a robust foundation for rental housing demand. Orlando’s booming entertainment and tech economy, Miami’s international finance and trade sector, and Tampa Bay’s growth in healthcare and defense all support consistent in-migration and job creation.

Top employers include AdventHealth, Publix Super Markets, HCA Healthcare, and Lockheed Martin. Florida is also a top destination for corporate relocations, with a steady influx of companies and talent seeking a favorable tax environment and business-friendly policies.

The state’s appeal goes far beyond business. With no state income tax, year-round sunshine, world-class beaches, and active lifestyle amenities, Florida continues to attract working professionals, retirees, and remote workers at scale.

At a Glance

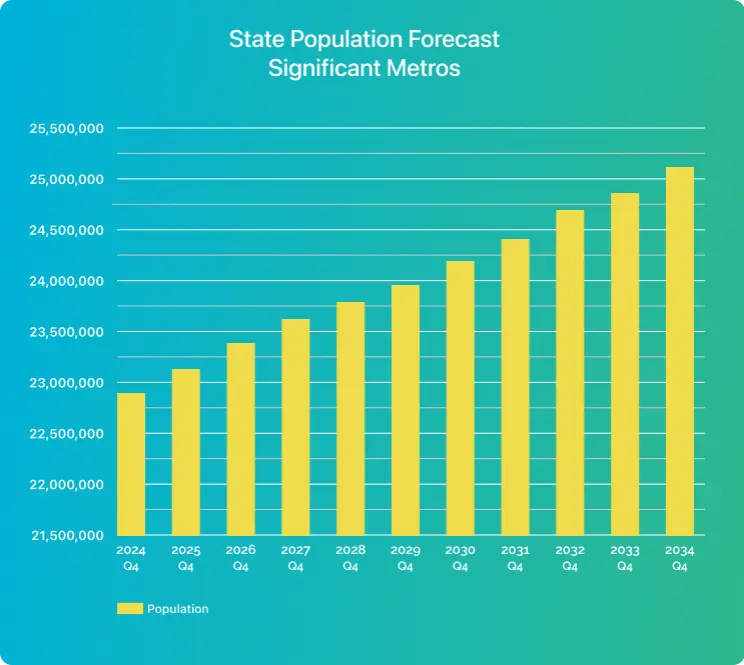

Population Growth

Nation-leading in-migration driven by jobs, climate, and tax advantages

Average Income

Strong income levels in metro regions with growth across key employment sectors

Number of Properties

Growing portfolio in Tampa, Orlando, Jacksonville, and South Florida markets

Management Approach

Agile strategies focused on tenant experience, NOI optimization, and risk mitigation

Market Insights

Florida’s rental markets are marked by tight occupancy, rising rents, and high investor interest—particularly in Class B and workforce housing segments. Submarkets like Kissimmee, Brandon, Cape Coral, and Palm Coast are seeing elevated demand as housing affordability becomes a more pressing issue in core metros.

Coastal regions face unique risk and compliance challenges, particularly around insurance, building codes, and storm resilience—areas where experienced, hands-on management can preserve asset value and reduce operating risk.

2024 Q4

22,883,584

2025 Q4

23,135,467

2026 Q4

23,346,239

2027 Q4

23,543,976

2028 Q4

23,731,455

2029 Q4

23,934,333

2030 Q4

24,152,254

2031 Q4

24,386,739

2032 Q4

24,616,317

2033 Q4

24,838,873

2034 Q4

25,054,639

Challenges

Insurance Costs

High and rising property insurance premiums impacting operating budgets

Climate and Compliance Risk

Proactive planning for storms, flood zones, and environmental regulation

Development Competition

Managing stabilized assets amid significant new supply in some metro areas

Looking Ahead

Florida’s population is expected to grow by over 13% from 2023 to 2033, one of the highest rates in the country. Continued expansion in healthcare, logistics, technology, and tourism will sustain job creation and bolster housing demand across asset classes.

Whether optimizing stabilized assets in Tampa or scaling operations in high-growth markets like Orlando and Jacksonville, our team brings localized insights and operational discipline to every Florida community we manage.

Local Presence,

Regional Expertise

Our Florida operations are supported by our Southeast Regional Headquarters in Atlanta, with dedicated on-site management teams positioned across the state.

Ready to Learn More?

Let’s talk about how we manage better in Florida.