Alabama

A Rising Market with Strong Roots and Solid Returns

Alabama’s multifamily housing market is gaining momentum, supported by economic diversification, a growing population, and expanding regional job centers. From Birmingham to Huntsville, Mobile to Montgomery, Alabama offers a mix of stable investment markets and emerging opportunities for multifamily growth.

At Summerfield Property Management, we bring operational excellence and local market insight to communities across Alabama—maximizing asset value and enhancing the resident experience.

What we love about Alabama

Alabama’s economy is powered by a balanced blend of manufacturing, aerospace, healthcare, and education. The state is home to major employers such as Mercedes-Benz, Hyundai, Honda, and Airbus, all of which have invested heavily in advanced manufacturing facilities that fuel job growth across the state.

Huntsville, now Alabama’s most populous city, is a national hub for aerospace and defense, anchored by Redstone Arsenal and NASA’s Marshall Space Flight Center. Birmingham remains a major healthcare and finance center, home to UAB Medicine, one of the largest academic medical systems in the country, employing more than 20,000 people.

In Mobile, the Port of Mobile and Airbus continue to drive economic expansion, while Montgomery benefits from a growing government and education employment base.

Alabama also attracts residents with its affordability, Southern lifestyle, and growing tech and remote work sectors, particularly in cities like Huntsville and Birmingham.

At a Glance

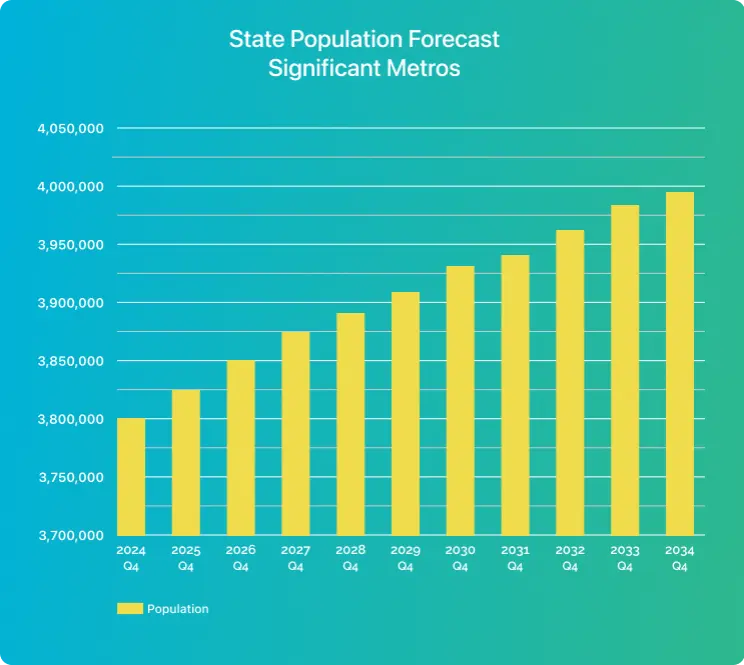

Population Growth

Steady in-migration to metro areas fueled by affordability and job creation

Average Income

Moderate incomes with upward trends in key job sectors

Number of Properties

Expanding footprint in Birmingham, Huntsville, and secondary markets

Management Approach

Cost-effective operations focused on resident retention and long-term value

Market Insights

Alabama’s rental housing market is marked by high occupancy and limited new supply in many markets. Huntsville leads the state in development and in-migration, thanks to its booming tech, aerospace, and defense sectors. Birmingham remains a stronghold for workforce housing, while coastal and southern markets like Mobile are seeing renewed interest from investors and developers.

With relatively low construction costs and growing economic stability, Alabama continues to draw attention from multifamily investors seeking reliable performance and long-term upside.

2024 Q4

3,801,402

2025 Q4

3,826,881

2026 Q4

3,849,470

2027 Q4

3,869,239

2028 Q4

3,887,903

2029 Q4

3,906,177

2030 Q4

3,923,878

2031 Q4

3,941,083

2032 Q4

3,957,380

2033 Q4

3,972,852

2034 Q4

3,987,574

Challenges

Aging Inventory

Rehabilitating and repositioning older multifamily stock in legacy markets

Labor and Material Costs

Managing renovation and maintenance expenses amid national supply pressures

Market Fragmentation

Navigating regional differences in property regulations, tenant expectations, and leasing trends

Looking Ahead

Alabama’s economy is projected to grow steadily over the next decade, with strong gains in aerospace, automotive manufacturing, and healthcare. As more professionals and families look to the state for affordable living and career opportunities, demand for well-managed rental housing is expected to rise across primary and secondary markets.

Whether repositioning workforce housing in Montgomery or scaling up operations in Huntsville’s high-demand neighborhoods, Summerfield Property Management is committed to maximizing performance in every Alabama asset.

Local Presence,

Regional Expertise

Our Alabama operations are supported through our Southeast Regional Headquarters in Atlanta, with on-site management teams delivering high-touch service statewide.

Ready to Learn More?

Let’s talk about how we manage better in Alabama.